By Abdulfatah Babatunde

The International Finance Cooperation (IFC) and the Central Bank of Nigeria (CBN) have signed a collaborative agreement to increase local currency financing.

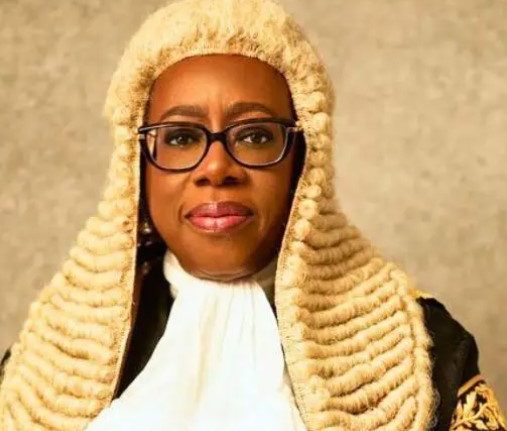

TheNewsZenith reports that Hakama Sidi-Ali, the CBN’s acting Director of Corporate Communications, announced the partnership in a statement on Monday in Abuja.

Sidi-Ali stated that the agreement was to enable private businesses in Nigeria to grow and thrive.

She said that the IFC, a member of the World Bank Group, aims to scale up its financing of critical sectors in Nigeria, to provide more than one billion dollars in the coming years.

“Those priority sectors included agriculture, housing, infrastructure, energy, small and medium enterprises and the creative and youth economy.

“Many of these sectors require local currency financing, and IFC’s partnership with the CBN is a key tool in expanding access.

“The partnership will allow IFC to manage currency risks and increase its investment in the Nigerian Naira across priority sectors of the economy,” she said.

In his remarks, CBN Gov. Yemi Cardoso said the pioneering initiative would unlock the long-term local currency financing for private businesses in Nigeria at economically viable rates.

Cardoso noted that the collaboration “marks significant progress in the CBN’s commitment to delivering innovative development initiatives.

“This is coming through reputable third-party service providers, moving beyond traditional intervention programmes.

Do you have a flair for Citizenship Journalism? Share stories of happenings in your area with TheNewsZenith on WhatsApp: 08033668669 or thenewszenithonline@gmail.com. Follow us on www.tiktok.com/@thenewszenithonline. Also, visit, subscribe and like our videos on YouTube @thenewszenithOnline