The average property price in the United Kingdom fell 1.0 per cent in May compared with the same period last year, the first annual decline since 2012, mortgage lender, Halifax said on Wednesday.

Month-on-month, UK house prices remained flat in May, with average UK property now costing £286,532 ($357,000).

Property prices have fallen by about £3,000 over last 12 months and are down around £7,500 pounds from peak last August.

“As expected, the brief upturn we saw in the housing market in the first quarter of this year has faded.

This is with the impact of higher interest rates gradually feeding through to household budgets.

In particular, those with fixed rate mortgage deals are coming to an end,” Director of Mortgages at Halifax, Kim Kinnaird, said.

To combat high inflation, the Bank of England in May, raised its benchmark interest rate to 4.5 per cent.

Read Related News:

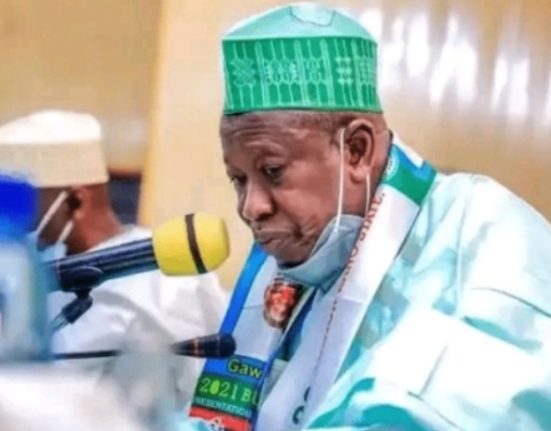

S/Arabia, UK, others meet Tinubu, pledge support, solidarity

UK businesses fear gloomy Christmas as cost of living soars

Rishi Sunak wins UK’s prime ministerial race

This is the highest interest rate since 2008.

The UK’s Consumer Price Index (CPI) inflation remained stubbornly high in April.

And mortgage players widely anticipate further rate hikes in the following months.

“This will inevitably impact confidence in the housing market as both buyers and sellers adjust their expectations.

“The latest industry figures for both mortgage approvals and completed transactions show demand is cooling.

Therefore, further downward pressure on house prices is still expected,” Kinnaird said. (1 pound = 1.25 U.S. dollar) (Xinhua)

Do you have a flair for Citizenship Journalism? Share story(ies) of happenings in your area with The NewsZenith on WhatsApp: 08033668669 or thenewszenith@gmail.com

1 Comment